#Scalable repayment options

Explore tagged Tumblr posts

Text

InstaCap Group: Flexible Repayment Term Loans for Growth

Need financial flexibility to grow your business without stress? Finding the right funding solution can be challenging, but InstaCap Group’s Flexible Repayment Term Loans make it simple. Whether you need capital for expansion, equipment, or operational costs, our structured yet adaptable repayment options ensure financial ease. With a seamless approval process and predictable payments, InstaCap Group helps businesses thrive without the burden of rigid loan structures. If you’re looking for a term loan with flexible repayment options, we’ve got you covered.

InstaCap Group’s Edge in Flexible Repayment Term Loans

When it comes to Flexible Repayment Term Loans, InstaCap Group stands out by offering tailored financing solutions designed for businesses of all sizes. Unlike traditional lenders with strict payment schedules, we provide adaptable repayment structures that align with your cash flow. Our quick approval process, transparent terms, and customer-focused service ensure that your business gets the funding it needs—without unnecessary delays or financial strain. With InstaCap Group, you receive a loan solution that truly supports your growth.

What Are Flexible Repayment Term Loans?

A Flexible Repayment Term Loan is a business financing option that provides a lump sum of capital, repaid over a set period with customizable terms. Unlike conventional loans with fixed monthly payments, these loans allow businesses to adjust repayment schedules based on revenue fluctuations. This flexibility helps companies manage cash flow efficiently, ensuring they can meet financial obligations without sacrificing growth opportunities.

Benefits of InstaCap Group’s Flexible Repayment Term Loans

Customizable Repayment Plans – Adjust payment schedules based on your business’s cash flow.

Predictable & Transparent Terms – No hidden fees or surprise charges.

Fast Approval Process – Get the funds you need quickly with minimal paperwork.

Supports Business Growth – Ideal for expansion, equipment purchases, or covering unexpected expenses.

Reliable Financial Partner – Access expert guidance and dedicated support throughout your loan term.

How to Use InstaCap Group’s Flexible Repayment Term Loans

Expanding Business Operations – Open new locations or invest in marketing strategies.

Purchasing Equipment – Upgrade machinery or invest in new technology.

Managing Cash Flow – Cover payroll, inventory, or unexpected expenses.

Investing in Growth Opportunities – Scale your business without immediate financial strain.

Secure Your Business’s Future with InstaCap Group Today!

Don’t let rigid loan structures hold your business back. With InstaCap Group’s Flexible Repayment Term Loans, you gain access to funding solutions that evolve with your needs. Whether you’re expanding, upgrading, or stabilizing cash flow, our loans are designed to fuel your business’s success. Apply today and take control of your financial future. Visit InstaCap Group for more details and secure your business loan now!

#Business financing options#Custom repayment plans#Small business funding#Business growth loans#Low-interest term loans#Commercial financing solutions#Fast business loans#Adjustable loan terms#Flexible business funding#Working capital loans#Easy loan application#Business expansion financing#Loan solutions for startups#Financial support for companies#Scalable repayment options

1 note

·

View note

Text

How Business Line of Credit from Capifina Can Help You Scale

Is your business ready to grow but worried about cash flow? A business line of credit from Capifina provides the flexibility to access funds when needed without the burden of long-term debt. Whether you're investing in inventory, expanding operations, or covering unexpected expenses, this financing option gives you control over your working capital. With fast approvals, flexible repayment options, and no collateral requirements, Capifina helps businesses scale without financial strain. Discover how a business line of credit can fuel your growth.

Why Choose Capifina’s Business Line of Credit?

Not all financing solutions offer the flexibility your business needs. Capifina’s business line of credit provides fast access to funds, with approvals up to $250,000 within 24 hours. Repayment is flexible, allowing you to choose weekly or monthly payments based on your cash flow. Unlike traditional loans, you only pay interest on what you use, giving you greater control over expenses. Plus, no collateral is required, and you can access funds anytime without reapplying, ensuring your business has the capital it needs to grow.

What is a Business Line of Credit?

A business line of credit is a flexible financing solution that allows businesses to access funds up to a predetermined limit. Unlike a traditional loan that provides a lump sum, a business line of credit lets you withdraw funds as needed and only pay interest on what you use. This funding option is ideal for businesses that experience seasonal fluctuations, need to cover short-term expenses, or want a financial cushion for unexpected costs.

Benefits of a Business Line of Credit

Improved Cash Flow – Keep your business financially stable by managing expenses efficiently.

Quick Access to Funds – Get approved and receive capital within 24 to 48 hours when needed.

No Long-Term Debt – Use the funds as required without committing to lengthy repayment terms.

Flexible Usage – Cover your essential expenses like payroll, inventory, marketing, or unexpected costs.

Lower Interest Costs – Pay interest only on the amount you withdraw, reducing overall borrowing expenses.

How to Use a Business Line of Credit

Inventory Purchases – Stock up on essential products without straining your cash reserves, ensuring you meet customer demand.

Payroll and Expenses – Keep operations running smoothly by ensuring employees and vendors are paid on time.

Seasonal Fluctuations – Manage cash flow effectively during peak seasons or slower business periods.

Marketing and Growth – Invest in advertising, promotions, and expansion efforts to scale your business.

Emergency Funding – Handle unexpected costs quickly without disrupting daily operations or long-term plans.

Get the Flexibility Your Business Needs with Capifina

Scaling your business shouldn’t come with financial stress. With a business line of credit from Capifina, you gain flexible, on-demand access to capital without the burden of long-term debt. Whether you need to manage cash flow, invest in growth, or cover unexpected expenses, Capifina has a financing solution tailored to your needs. Apply now at Capifina and take your business to the next level.

#Capifina#Capifina business credit line#Instant working capital credit#Revolving credit for small businesses#On-demand business credit funding#Customizable credit lines for businesses#Fast-access business financing#Hassle-free business credit approval#Pay-as-you-use business credit#Business liquidity solutions#Cash flow-friendly credit options#Growth-focused business lending#Flexible repayment credit lines#No-commitment business credit access#Quick-draw credit for entrepreneurs#Scalable financing for businesses

1 note

·

View note

Text

The OGSCapital Review Business Plan Creation Process

When it comes to securing funding, attracting investors, or launching a successful business, the importance of a professionally crafted business plan cannot be overstated. A strong plan doesn't just tell your story—it proves your potential. For over a decade, OGSCapital has been a global leader in helping entrepreneurs, startups, and established companies build fundable, persuasive business plans tailored to their unique goals.

In this post, we’ll take you behind the scenes and walk through the OGSCapital business plan creation process, so you know exactly what to expect when working with one of the most trusted names in the industry. Based on multiple OGSCapital Review sources and client testimonials, it’s clear that their method is as strategic as it is personalized.

Step 1: Initial Consultation – Understanding the Vision

The OGSCapital business plan process begins with a discovery phase. During this step, their team engages in a one-on-one consultation to deeply understand your business idea, objectives, funding goals, and timeline. This call is not just a formality—it’s the foundation of the entire plan. You’ll be asked key questions about:

Your business model and target market

Industry background

Funding needs and goals

Any available data, research, or projections

Key team members and resources

OGSCapital Review Insight: Clients consistently report that the OGSCapital team listens attentively and asks smart, relevant questions. Many say this initial conversation helped them gain clarity on their own ideas and strategy.

Step 2: Market Research and Competitive Analysis

Once the OGSCapital team has a clear understanding of your business, they move into the research phase. This is where they gather data that will shape your market strategy and validate your opportunity. Their research process includes:

Industry analysis using credible databases

Market trends and consumer behavior insights

Target audience segmentation

Competitive landscape review

Identifying gaps and opportunities in the market

Why this matters: Lenders and investors want proof that there’s real demand for your product or service. A vague “we expect to capture 5% of the market” won’t cut it. OGSCapital backs up every claim with reliable data and a logical path to market entry and growth.

Step 3: Strategic Planning and Structuring the Document

Next comes the strategic structuring of your business plan. OGSCapital doesn’t use cookie-cutter templates. Instead, they build a custom structure based on your industry, funding target, and intended audience (banks, VCs, SBA lenders, grant agencies, etc.). A typical OGSCapital business plan includes:

Executive Summary

Company Description

Products or Services Overview

Market Analysis

Marketing and Sales Strategy

Operational Plan

Management and Organization Structure

Financial Projections

Funding Request

Appendix (optional)

OGSCapital Review Insight: Many clients appreciate how the team takes the guesswork out of structure and formatting. They know exactly what each type of investor or lender expects to see, and they tailor your plan accordingly.

Step 4: Writing the Plan – Clear, Professional, and Persuasive

With the research complete and structure in place, OGSCapital’s team of business writers and editors begin crafting the narrative of your business plan. This step brings together everything they've learned about your business and your market in a compelling, investor-friendly way. The writing is:

Clear and professional

Focused on your unique value proposition

Customized to reflect your voice and branding

Free of jargon and vague promises

The tone is adjusted depending on your audience. For example, a bank loan application might focus more on stability and repayment ability, while a VC pitch plan would emphasize growth potential, scalability, and innovation.

OGSCapital Review Insight: Clients often praise OGSCapital’s ability to translate complex ideas into simple, persuasive language. The writing is not just informative—it’s crafted to persuade.

Step 5: Financial Modeling – Realistic, Defensible, and Aligned with Your Vision

Arguably the most critical part of any business plan is the financial section. Many entrepreneurs struggle with this on their own, but OGSCapital’s team includes financial analysts who build detailed, investor-grade projections. This section usually includes:

Profit and Loss (P&L) Statement

Cash Flow Projections

Balance Sheet

Break-even Analysis

Revenue Assumptions and Cost Structures

What sets OGSCapital apart is how they justify the numbers. Every forecast is backed by market data, logical assumptions, and a deep understanding of your business model.

OGSCapital Review Insight: Clients frequently mention how helpful the financial modeling is—not just for fundraising, but for managing internal expectations and setting goals. Investors often comment positively on how well the financials align with the narrative of the plan.

Step 6: Review and Revisions – Collaborative and Transparent

OGSCapital doesn’t just deliver a plan and walk away. Once the first draft is completed, they share it with you for review and feedback. You’re encouraged to suggest edits, ask questions, and work collaboratively to refine the final version. You’ll be able to:

Request content revisions or clarifications

Adjust financial assumptions if needed

Confirm the tone, formatting, and structure

The process is transparent and collaborative, with most clients going through one or two rounds of revision to ensure everything is perfect.

OGSCapital Review Insight: The revision process is consistently highlighted as a major strength. Clients appreciate the responsiveness and professionalism of the team, as well as their willingness to make adjustments until the final product meets (or exceeds) expectations.

Step 7: Final Delivery – Investor-Ready and Presentation-Perfect

After revisions are complete, you’ll receive your finalized business plan in multiple formats—typically PDF and Word. Some packages also include a pitch deck, executive summary, or PowerPoint presentation, depending on your funding goals. The final plan is:

Professionally formatted and branded

Visually appealing (including charts and graphics)

Ready to share with banks, investors, grant agencies, or partners

OGSCapital Review Insight: Clients often note how proud they are to share the final product with investors. The polished, professional look of the plan adds credibility to their pitch and makes a strong first impression.

Conclusion: A Proven, Professional Process That Delivers Results

The OGSCapital business plan creation process is thorough, strategic, and deeply customized. From the initial consultation to the final delivery, their team is focused on one goal: helping you succeed.

If you’re preparing to raise capital, apply for a loan, or launch a new business, working with an expert team like OGSCapital can dramatically improve your chances of success. As highlighted in many an OGSCapital Review, their proven process has helped thousands of entrepreneurs around the world turn ideas into fundable, investor-ready plans. Why Choose OGSCapital?

Over 5,000 business plans written

50+ industries served

Financial analysts, MBAs, and business writers on staff

Global clientele in the U.S., Canada, Europe, and beyond

Customized, data-driven, investor-focused plans

If you want to take the next step toward funding and growth, visit OGSCapital to schedule a consultation.

0 notes

Text

How NBFCs Are Leveraging Technology for Financial Inclusion in India

India’s financial landscape is undergoing a major transformation, and Non-Banking Financial Companies (NBFCs) are at the forefront of this change. Traditionally serving segments that are underserved or excluded by banks, NBFCs have played a key role in bridging the financial inclusion gap. But what’s truly driving their scale and success today is technology.

In this article, we’ll explore how NBFCs are using technology to expand their reach, streamline operations, and empower India’s unbanked population.

What is Financial Inclusion?

Financial inclusion means ensuring that individuals and businesses have access to affordable and useful financial products — including credit, insurance, savings, and payments — delivered in a responsible and sustainable manner.

Millions in India, especially in rural and semi-urban areas, still lack access to formal banking services. This is where NBFCs step in with customized, tech-enabled financial solutions.

How NBFCs Are Leveraging Technology

1. Digital Onboarding and eKYC

NBFCs now offer paperless onboarding through Aadhaar-based eKYC, video KYC, and PAN verification. This simplifies the process of account opening and loan applications — especially in remote areas where physical document collection is difficult.

Real-time identity verification

Faster loan approvals

Reduced fraud and human error

2. AI & ML for Credit Scoring

Traditional banks often reject applicants due to a lack of formal credit history. NBFCs are changing this by using alternative data and AI-powered credit scoring models.

They analyze:

Mobile usage patterns

Utility bill payments

Social media activity

Transaction history (via UPI)

This helps assess the creditworthiness of first-time borrowers and gig workers who may not have a CIBIL score.

3. Cloud-Based Core Lending Platforms

Modern NBFCs use cloud-native core systems to manage:

Loan origination

Disbursement

Repayments

NPA tracking

These platforms reduce operational costs and allow easy scalability, even for small NBFCs operating in Tier 2 and Tier 3 cities.

4. Mobile Lending Apps

NBFCs have launched user-friendly mobile apps for loan applications, EMI payments, and customer service. These apps support regional languages and intuitive design — making them accessible to non-tech-savvy users.

Some NBFCs also use WhatsApp banking and IVR-based services for last-mile access.

5. Digital Payment Integration

NBFCs have integrated with UPI, Bharat BillPay, and AEPS (Aadhaar Enabled Payment System) to simplify collections and repayments. This improves cash flow management and makes borrowing more flexible.

Instant disbursement via UPI

EMI reminders and autopay options

Rural agents can accept payments through biometric devices

6. Field Force Digitization

NBFCs with physical agents now use mobile CRMs and geo-tagging tools to track field officers in real time. This increases accountability, improves loan recovery, and brings transparency to doorstep banking models.

Impact on Financial Inclusion

Thanks to tech adoption, NBFCs have been able to:

Reach millions of new-to-credit customers

Offer micro-loans and small-ticket finance with minimal paperwork

Empower women, farmers, and small businesses with digital tools

Create employment opportunities through agent-based models

Reduce dependency on informal credit sources (like moneylenders)

Real-World Examples

LendingKart: Uses data analytics to give small business loans with zero collateral

Aye Finance: Uses biometric KYC and psychometric tests for micro-entrepreneurs

KreditBee: Offers short-term digital loans to salaried and self-employed youth

Svatantra Microfin: Offers digital financial products to women in rural India

Compliance and Data Security

Technology also helps NBFCs stay compliant with RBI guidelines by:

Enabling secure data storage

Providing audit trails

Integrating with credit bureaus

Ensuring GDPR and IT Act compliance

As NBFCs grow digitally, cybersecurity and data protection are being treated as top priorities.

What’s Next for Tech-Driven NBFCs?

The future of NBFCs is digital-first. We can expect:

Blockchain-based loan contracts for transparency

Voice-enabled banking in regional languages

AI chatbots for 24/7 customer service

BNPL (Buy Now Pay Later) options integrated with UPI apps

Open banking APIs connecting NBFCs with fintechs and marketplaces

Conclusion

NBFCs are not just filling the gaps left by traditional banks — they’re leading innovation in financial services, especially for the underbanked. By embracing technology, NBFCs are accelerating India’s journey toward true financial inclusion, one digital step at a time.

For More Information Visit us: https://www.bharatinttech.com/

0 notes

Text

best microfinance software

Microfinance software is a specialized type of software designed to help microfinance institutions (MFIs) manage their operations, streamline loan processes, and provide financial services to low-income individuals and small businesses. It automates various tasks, from loan origination and disbursement to repayment tracking and accounting, significantly improving efficiency and reducing errors.

Key Features of Microfinance Software:

Loan Management: This is the core function, encompassing the entire loan lifecycle from application to repayment. Features include:

Loan origination and processing (digital applications, credit scoring, risk assessment)

Loan disbursement (electronic fund transfers)

Repayment tracking and automated reminders

Default and delinquency management

Configurable loan products (interest rates, tenure, charges)

Client Management (CRM): Manages customer data, including demographics, financial history, and relationships. It often includes features for:

Customer onboarding and eKYC (e.g., Aadhaar verification in India)

Customer analytics for better decision-making

Accounting and Financial Reporting: Ensures accurate and timely financial information, typically including:

Chart of accounts

Automated journal entries

Financial activity mapping

Tax configurations

Real-time reporting and dashboards (e.g., loan portfolio performance, NPA reporting)

Audit trails

Branch and Employee Management: For MFIs with multiple branches, this helps manage operations across different locations and track employee performance.

Scalability: The ability of the software to grow with the MFI, accommodating more clients, loans, and transactions.

Security and Data Protection: Robust measures to safeguard sensitive financial data, prevent fraud, and ensure compliance.

Integrations:

Mobile Banking Integration: Crucial for reaching clients who primarily use mobile phones.

API Integration: Allows seamless connection with other systems like credit bureaus (e.g., CIBIL, CRIF, Equifax in India), payment gateways, and bank statement analyzers.

SMS Integration: For automated payment reminders and communication.

Customizability: The ability to tailor the software to specific MFI needs and create custom loan products.

Risk Management: Tools for assessing and identifying creditworthiness, and monitoring borrower behavior.

Regulatory Compliance: Features that ensure adherence to industry standards and regulations (e.g., RBI guidelines in India).

Benefits of Microfinance Software:

Increased Efficiency and Speed: Automates manual tasks, reducing processing time for applications, approvals, and disbursements.

Reduced Operational Costs: Minimizes the need for manual intervention and paperwork, saving on labor and administrative expenses.

Minimized Errors: Automation significantly reduces human errors in calculations and data entry.

Enhanced Data Security and Compliance: Robust security features and built-in compliance tracking protect sensitive data and ensure regulatory adherence.

Improved Decision-Making: Real-time data and advanced analytics provide valuable insights into MFI performance.

Better Customer Experience: Faster loan approvals, personalized services, and easy repayment options lead to higher customer satisfaction.

Scalability and Growth: Enables MFIs to expand their operations without significant cost increases.

Financial Inclusion: By streamlining processes and reaching remote areas through mobile integration, it helps extend financial services to the unbanked and underbanked.

Top Microfinance Software Solutions:

Some of the prominent microfinance software solutions include:

CloudBankin: A comprehensive integrated banking software solution ideal for both group and individual microfinance lending.

Craft Silicon (BR.NET): Offers a suite of products covering the entire microlending value chain, including core loan management, origination, collection, and analytics.

Jayam Solutions (Microfinance ERP): Provides ERP solutions specifically for microfinance institutions.

OpenCBS: Offers open-source cloud-based core banking system with features like client management, loan origination, and a tablet application for field operations.

Apache Fineract: An open-source, cloud-ready core banking system designed for digital financial services, promoting financial inclusion.

Musoni: Known for its innovative solutions in microfinance.

CoBIS Microfinance Software: A banking system for managing accounting, clients, suppliers, and loan portfolios.

Genius Microfinance Software

Microdot Softwares

Santhosh Microfinance Software

LendFusion: Focuses on quick credit decisions, automated disbursements, and borrower portals.

Hubco.in: Offers customizable microfinance software with a strong focus on automation and analytics.

Pricing:

Microfinance software pricing can vary significantly based on features, scalability, deployment (cloud-based vs. on-premise), and vendor. Some options include:

One-time purchase: Some vendors offer a one-time fee, with prices ranging from around INR 10,000 to INR 1,70,000 or more, depending on the complexity.

Subscription-based (SaaS): Many cloud-based solutions operate on a monthly or annual subscription model, which can start from INR 2,000 per month or INR 20,000 annually for basic packages and go much higher for more advanced features and larger scale.

Free/Open Source: Solutions like Apache Fineract and Mifos are open-source and can be downloaded for free, but may require technical expertise for implementation and maintenance.

0 notes

Text

How to Build a Future-Proof Smart Home on a Budget

The demand for smart homes is growing rapidly. As daily life becomes more connected, homeowners are seeking ways to upgrade their spaces with intelligent features. Bilva Home Solutions has emerged as a trusted guide in this journey. As the best home loan broker in Black Town, they offer not only financing solutions but also help in planning practical, smart homes without overspending.

Start with a Solid Plan

A future-proof smart home begins with a clear plan. List your priorities. Focus on core areas like lighting, security, and energy efficiency. Avoid going for flashy gadgets at the start. Instead, choose products that support upgrades. Bilva Home Solutions helps clients choose smart systems that work with existing structures and allow future add-ons.

Choosing the right financing is the next step. The best home loan broker in Black Town provides loan options tailored to these needs. Bilva Home Solutions ensures your budget stretches further by identifying loans with low interest rates and flexible repayment terms. With the right loan, long-term smart investments become possible without financial strain.

Choose Scalable Smart Devices

Invest in smart devices that grow with your needs. Begin with smart lighting and thermostats. These reduce power bills and provide convenience. Next, consider smart locks and security cameras. Look for devices that connect through a single platform. This ensures smooth control and avoids the cost of multiple systems later.

Bilva Home Solutions guides buyers through cost-effective choices. As the best home loan broker in Black Town, they also maintain partnerships that bring added value during purchases, helping homeowners secure better deals on smart appliances and installations.

Energy Efficiency as a Priority

Smart homes must focus on energy efficiency. Install solar panels where possible. Use smart meters to track usage in real time. Smart switches and plugs can help manage energy better, turning off unused appliances automatically. These small features cut electricity bills and contribute to long-term savings.

Bilva Home Solutions factors energy planning into the loan structure. They offer loan products that support energy-related upgrades, making it easier to integrate efficient systems into your home design.

Secure Your Home the Smart Way

Home security is another pillar of a future-ready home. Smart cameras, motion sensors, and alarms offer peace of mind. These systems are no longer expensive. Affordable versions with remote access and mobile alerts are now available. Choose systems that work without complex wiring, so upgrades stay simple.

Through detailed consultation, Bilva Home Solutions aligns financing with security needs. Their knowledge of the local market helps homeowners select the right features at the right price.

The Final Word

Building a smart home does not mean draining your savings. With careful planning and the right support, any homeowner can step into a smarter lifestyle. The best home loan broker in Black Town, Bilva Home Solutions, makes this path easier by offering practical guidance and financial solutions tailored to modern housing needs.

They stand behind every project with insight, reliability, and a strong understanding of what makes a smart home truly future-proof.For more details visit our website:https://bilvahomesolutions.com.au/

0 notes

Text

Unlocking Growth: How Wholesale Funding Fuels Business Expansion

Wholesale funding offers businesses a powerful financial pathway to scale operations, enhance working capital, and invest in growth without diluting ownership. Unlike traditional lending, it provides flexible, tailored capital solutions that align with specific business needs. Whether you're financing new equipment, acquiring inventory, or bridging cash flow gaps, wholesale funding delivers speed and structure. In this blog, we explore how wholesale funding drives sustainable business expansion and operational success.

Key Ways Wholesale Funding Supports Business Growth:

1. Access to Large-Scale Capital Efficiently Wholesale funding gives businesses the ability to access substantial amounts of capital without the delays of conventional financing. These high-limit facilities allow for immediate use of funds to fuel urgent business opportunities, whether it’s scaling operations or launching new projects.

2. Non-Dilutive Financing Options One of the major benefits of wholesale funding is the ability to raise capital without giving up equity. This allows founders and shareholders to maintain control while still obtaining the resources necessary to drive expansion, hire talent, or enter new markets.

3. Enhanced Cash Flow Management With options like receivables finance and growth funding, businesses can smooth out cash flow volatility. These solutions turn outstanding invoices or revenue potential into immediate liquidity, helping cover operational costs and prevent cash flow crunches.

4. Tailored Lending Structures for Flexibility Wholesale funding solutions can be customised to match your business's specific needs—offering different facility limits, terms, and repayment structures. This flexibility allows businesses to align funding with revenue cycles, project timelines, and strategic goals.

5. Asset-Backed Lending for Security and Scalability Using tangible assets like equipment or inventory as collateral allows businesses to secure favourable terms and access higher credit limits. Asset-backed lending under wholesale finance is ideal for companies with significant physical assets seeking rapid growth.

6. Competitive Interest Rates and Terms Wholesale funding providers typically offer competitive interest rates due to the larger scale and lower risk profiles of secured lending. This means reduced cost of capital and better returns on investment as funds are deployed into productive areas of the business.

7. Speed and Simplicity in Approval With streamlined application processes and rapid approvals, wholesale funding can be deployed quickly—making it an excellent choice for businesses needing urgent capital. Fast decision-making ensures growth opportunities aren’t lost due to funding delays.

Wholesale funding is a strategic tool for companies ready to scale without sacrificing ownership or getting entangled in rigid bank processes. By offering flexible, fast, and tailored capital solutions, it supports sustained growth, improved cash flow, and long-term success.

To explore how wholesale funding can accelerate your business expansion, visit Rixon Capital PTY LTD and discover our tailored Wholesale Funding Solutions built for growth-focused businesses.

1 note

·

View note

Text

The Allure Of Gold Loans For NBFCs

In recent years, Non-Banking Financial Companies (NBFCs) in India have increasingly ventured into the gold loan segment, recognizing it as a lucrative and strategic avenue for growth. This shift is driven by a confluence of factors, including the rising demand for accessible credit, the cultural significance of gold in Indian households, and the operational advantages that gold loans offer to both lenders and borrowers.

The Appeal of Gold Loans for NBFCs

Gold loans have emerged as a preferred credit option for many Indians due to their ease of access, minimal documentation requirements, and quick disbursal times. Unlike unsecured loans, gold loans are secured by the borrower's gold assets, reducing the risk for lenders and often resulting in lower interest rates for borrowers. This makes them particularly attractive to individuals who may lack a formal credit history or have immediate financial needs.

For NBFCs, gold loans represent a stable and profitable product. The secured nature of these loans leads to lower default rates, and the high liquidity of gold ensures that lenders can recover their funds efficiently in case of non-repayment. Additionally, the operational simplicity and scalability of gold loan products allow NBFCs to expand their reach, especially in rural and semi-urban areas where traditional banking services may be limited.

Also Read: Poonawalla Fincorp Limited Launches Fully Digital Personal Loan for Salaried Professionals

Market Dynamics and Growth Potential

The Indian gold loan market has witnessed significant growth, with the organized sector's share increasing from 10% in 2014 to 32% in 2024. Despite this, a substantial portion of the market remains.

Also Read: Poonawalla Fincorp Launches Gold Loans to Strengthen Secured Lending Offerings

Poonawalla Fincorp's Entry into Gold Loans

Recognizing the potential of the gold loan market, Poonawalla Fincorp Limited, a prominent NBFC, has recently launched its gold loan services. This strategic move aligns with the company's objective to diversify its product portfolio and cater to a broader customer base. Arvind Kapil, Poonawalla Fincorp’s CEO and Managing director said, “Our gold loan offering represents a natural progression in our secured lending portfolio, combining traditional value with modern convenience.”

By leveraging its existing infrastructure and technological capabilities, Poonawalla Fincorp aims to offer competitive interest rates, swift loan processing, and superior customer service in the gold loan segment. This initiative not only enhances the company's market presence but also contributes to financial inclusion by providing accessible credit options to underserved populations.

Also Read: The Rise of NBFCs in the Lending Market: Key Drivers and Recent Trends

Conclusion

The foray of NBFCs into the gold loan sector underscores a significant shift in the Indian financial landscape, reflecting the evolving needs of borrowers and the adaptability of financial institutions. By offering secure, efficient, and customer-centric loan products, NBFCs are not only tapping into a vast and growing market but also playing a pivotal role in promoting financial inclusion and economic resilience. As the sector continues to mature, adherence to regulatory standards and a focus on customer trust will be crucial in sustaining growth and ensuring the long-term success of gold loan offerings.

0 notes

Text

CMEGP Project Report for Trading Business

Setting up a trading business under government-backed financial schemes has become a popular route for new entrepreneurs. One such scheme is the Chief Minister’s Employment Generation Programme (CMEGP), which provides margin money subsidies linked with bank loans. To qualify, applicants must submit a comprehensive and well-prepared project report for a bank loan.

Whether you’re applying for a CMEGP loan, Mudra loan, or PMEGP loan, a well-structured project report for business is essential for approval. A trading business—dealing in FMCG, electronics, garments, or hardware—is ideal for these schemes because of its low investment needs and rapid cash flow cycle.

Executive Overview

The proposed business, “Sai Traders”, will operate from a 300 sq. ft. rented shop in Hubballi, Karnataka, dealing in fast-moving consumer goods (FMCG) such as soaps, packaged snacks, detergents, and kitchen essentials. The total project cost is estimated at ₹10,00,000, with the applicant contributing ₹1,50,000 from personal savings. The remaining ₹8,50,000 is being sought as a PMEGP loan, with an expected subsidy of ₹2,00,000 under the scheme.

This structure is compatible with Mudra loan norms and also fits within the eligibility limits of the PMEGP loan.

Promoter Profile

The promoter is a graduate with three years of retail experience in FMCG distribution. They have also completed an Entrepreneurship Development Programme (EDP), as required under CMEGP and PMEGP guidelines. This strengthens the eligibility for receiving financial aid from the bank and the government.

Business Description

The business will:

Procure goods from authorized FMCG distributors.

Sell both wholesale to local kirana shops and retail to walk-in customers.

Offer credit to regular buyers and digital billing to enhance customer experience.

This model is simple yet scalable and is considered highly suitable under Mudra loan and CMEGP loan structures. A small shop, efficient inventory system, and competitive pricing will provide the promoter with a solid foundation for growth.

Market Feasibility

The area has high demand for FMCG goods due to dense population and limited competition. Local shops often face stock shortages and limited credit access. By offering reliable supply and better service terms, Sai Traders can quickly establish a customer base. These insights add value to the project report for bank loans and prove the business’s sustainability under schemes like PMEGP loan.

Technical Feasibility

Shop Setup: 300 sq. ft. rented space in a central marketplace.

Infrastructure: Racks, display counters, billing machine.

Manpower: One sales assistant and one delivery helper.

Inventory: Monthly restocking based on local demand.

The low technical complexity of trading businesses makes them perfect for CMEGP loans and Mudra loans, both of which aim to support quick-launch, job-generating ventures.

Financial Structure

The ₹10 lakh project cost will be financed through:

₹1.5 lakh promoter contribution.

₹8.5 lakh as bank loan.

₹2 lakh expected as CMEGP subsidy.

Funds will be used for shop setup, initial inventory, working capital, and basic equipment. This structure complies with the guidelines of both PMEGP loan and Mudra loan, making the business viable for multiple funding options.

Repayment Plan

The proposed bank loan will be repaid over five years with monthly EMIs of approx. ₹16,000. A six-month moratorium is requested to ease initial cash flow. Such clear repayment planning is key to any project report for loan and ensures lender confidence.

Employment Generation

The business will directly employ two people and indirectly support logistics and local vendors—aligning with the employment objectives of PMEGP, CMEGP, and Mudra schemes.

Conclusion

A solid CMEGP project report for trading business is not just a formality—it’s your tool for unlocking government-backed financial support. Whether you're applying for a PMEGP loan, Mudra loan, or bank loan, ensure your project report for business is clear, realistic, and bankable.

Want a customizable report template in Word or PDF? Reach out to us for state-compliant, ready-to-submit formats tailored to your industry. For additional information or assistance, please contact us or call us at +91-8989977769.

0 notes

Text

Managing Debt Wisely and Investing in Growth. A Strategic Balance for Modern Fintech Leaders

Managing business debt effectively is a strategic skill — not a reactive measure. Whether it’s to finance expansion, support new infrastructure, or cover short-term operational needs, debt can be a useful tool. But left unchecked or misaligned with company goals, it can quickly limit a business’s ability to grow.

As the financial environment evolves in 2025, with high interest rates, tighter credit markets, and changing investor expectations, fintech leaders are reevaluating how they approach leverage. Sustainable growth increasingly depends on balancing borrowing with sound capital deployment. The key lies in knowing when to borrow, how much to borrow, and where to invest the proceeds for long-term return.

Understanding Modern Debt Instruments in Fintech.

Debt in the fintech world isn’t confined to traditional bank loans. Today’s options include:

Revenue-based financing: Popular among startups with consistent earnings, this model allows repayment as a percentage of future revenue.

Convertible notes: Used in early-stage companies, offering investors debt that can convert into equity.

Venture debt: Typically used alongside equity funding to extend runway or support new product launches.

Lines of credit: Flexible and revolving, suitable for managing seasonal cash flow fluctuations.

Each structure comes with unique obligations and timelines. Selecting the wrong type of debt — or misjudging the company’s ability to repay — can result in constrained cash flow or restrictive covenants that hinder operations.

Eric Hannelius, CEO of Pepper Pay, remarks: “Debt should match the rhythm of your business model. If you’re investing in recurring revenue, it makes sense to borrow against that. If you’re funding innovation, look for flexible terms that don’t handcuff your product team.”

Assessing Debt Capacity Before Borrowing.

Before taking on debt, fintech leaders need a clear view of:

Current cash flow: Can the business comfortably cover interest payments and principal without jeopardizing core operations?

Revenue stability: Are revenue projections based on contracts, subscriptions, or one-off transactions?

Contingency reserves: In case of slower-than-expected growth, is there a buffer to continue repayments?

Debt-to-equity ratio: Investors and credit agencies may evaluate whether the company is overleveraged based on this ratio.

Without these guardrails, debt can erode margins or force premature fundraising, often under unfavorable conditions.

Smart Debt Allocation: Fuel for Growth, Not a Lifeline.

Debt can be highly effective when used to fund projects with defined returns. Common growth-focused uses include:

Product development: Launching new features or expanding platform capabilities.

Market expansion: Entering new geographies or customer segments.

Technology upgrades: Enhancing infrastructure for better scalability or compliance.

Customer acquisition: Scaling marketing efforts when there’s a measurable return on ad spend.

Debt Management Tactics for 2025.

With interest rates still elevated and credit scrutiny increasing, businesses must apply more discipline than in previous years. Key tactics include:

Renegotiating Terms: If rates have shifted since the loan was issued, it may be possible to refinance at a more favorable structure.

Creating a Debt Schedule: A detailed calendar of payments and maturity dates helps manage obligations and avoid surprises.

Tying Debt to Specific KPIs: Linking borrowing decisions to revenue, user growth, or churn rates encourages data-driven deployment.

Integrating Debt Planning Into Forecasting: Scenario modeling should include the impact of rising or falling revenue on debt coverage ratios.

Eric Hannelius adds: “Using debt for growth means being precise. If a dollar of debt doesn’t turn into several dollars of future income, it’s not an investment — it’s a liability.”

Conversely, using debt to cover basic expenses — such as payroll or overhead — can be a warning sign of deeper financial imbalance.

0 notes

Text

Seamlessly Manage Loans with Our Cloud-Based Loan Management System—Perfect for Financial Services.

Servicing MSME loans can be time-consuming and error-prone—especially for institutions using outdated systems. CredAcc’s Loan Management System provides a modern solution that automates and simplifies loan servicing while improving accuracy and borrower experience.

Designed for India’s dynamic banking and NBFC sectors, this Loan Management System automates post-loan workflows like collections, repayments, and borrower communication. By reducing manual intervention, it cuts down on operational costs while increasing speed and efficiency.

The platform’s API-first design ensures seamless integration with existing banking systems. Banks and NBFCs can easily plug in CredAcc’s Loan Management System to their tech stack without overhauling their core platforms. This flexibility makes it ideal for institutions of all sizes.

What makes CredAcc’s solution stand out is its ability to deliver end-to-end loan lifecycle management. Once a loan is disbursed, the system takes over everything—sending EMI reminders, tracking payments, updating ledgers, and alerting borrowers. This level of automation allows internal teams to focus on strategy rather than routine admin tasks.

Collections are more efficient as the Loan Management System automatically identifies missed payments and triggers alerts. Borrowers receive timely notifications, and recovery efforts can begin without delay. This proactive system improves repayment rates and reduces delinquencies.

Furthermore, the platform is built to meet the needs of India’s regulatory and operational landscape. Whether you need to support flexible payment terms or maintain audit trails, CredAcc’s Loan Management System offers configurable options for compliance and reporting.

For institutions looking to grow their MSME portfolio, CredAcc offers scalability and performance. The platform is cloud-ready, secure, and supports high transaction volumes without latency issues.

Ultimately, CredAcc’s Loan Management System enables lenders to operate smarter. By removing bottlenecks and automating key tasks, it improves not just productivity but also the borrower experience. Clear communication, timely updates, and seamless payment processes build trust and ensure higher customer satisfaction.If your institution is ready to upgrade from manual processes to intelligent automation, it’s time to explore CredAcc’s Loan Management System. Embrace the future of MSME loan servicing—faster, better, and fully digital.

0 notes

Text

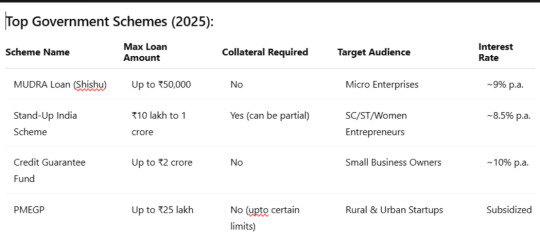

Top Government Loan Schemes for New Business Startups in India (2025 Updated List)

Starting a business in India is an exciting journey, but turning an idea into a profitable venture often requires one critical resource — capital. In 2025, the Indian government continues to empower entrepreneurs through various loan schemes, including the popular Startup India Loan Scheme and other government loans for new business startups in India. Additionally, options like business loans against property in India offer access to higher funding with lower interest rates.

If you're looking to kickstart your startup or scale your small business, this complete guide covers everything — from how to apply for a business loan online to the best paperless business loan online approval platforms. We’ll also compare options for those needing unsecured business loans without income proof or working capital loans for small businesses in India.

What Is the Startup India Loan Scheme?

Launched in 2016, the Startup India Loan Scheme is a flagship initiative by the Government of India. It offers financial support to eligible startups via various financial institutions, including banks, NBFCs, and SIDBI (Small Industries Development Bank of India).

Key Features:

Collateral-free loans up to ₱10 crore

Interest subsidies for eligible borrowers

Tailored for tech-based, scalable startups

Support via Fund of Funds and Credit Guarantee Scheme

Who Is Eligible?

Registered startups under the DPIIT (Department for Promotion of Industry and Internal Trade)

Age of entity: less than 10 years

Annual turnover: Less than ₱100 crore

Must be innovative and scalable

Government Loan for New Business Startup in India

Besides the Startup India Scheme, several other government loans for new business startups in India are designed for first-time entrepreneurs, women-led businesses, and micro-enterprises.

These schemes not only provide funding but also offer mentorship, tax benefits, and technical support.

Business Loan Against Property in India

For startups and SMEs requiring high-value funding, a business loan against property in India is a reliable option. These loans are secured against residential or commercial property, which significantly lowers the interest rate.

Benefits:

Loan amounts up to ₹7 crore or more

Interest rates from 8% to 12% per annum

Tenure up to 15 years

Quick disbursal and minimal documentation

Who Should Consider?

Businesses needing capital for expansion

Startups with valuable property assets

Borrowers with good credit profiles

How to Apply for Business Loan Online in India

The digital revolution has made it easy to apply for a business loan online without visiting a branch. Here's a quick step-by-step process:

Online Application Process:

Visit the lender's official website or app

Choose the loan product (Startup loan, LAP, Working Capital)

Fill out basic business and personal information

Upload documents (Aadhar, PAN, bank statements, ITR, property papers)

Wait for eligibility check and soft credit pull

Get paperless loan approval and sign agreement digitally

Note: Many platforms offer paperless business loan online approval within 24–72 hours.

Unsecured Business Loan Without Income Proof

If you don’t have audited financials or ITRs, an unsecured business loan without income proof could still be possible — though approval depends heavily on credit score, business turnover, and bank statement analysis.

Where to Apply:

Fintech lenders like Lendingkart, Indifi, and FlexiLoans

Some NBFCs specialize in unsecured loans

Credit card-based working capital loans

Requirements:

Minimum 6–12 months business vintage

Monthly turnover over ₹50,000

Good repayment history or CIBIL score

Working Capital Loan for Small Businesses in India

Every small business needs liquidity for daily operations. A working capital loan for small businesses in India helps cover expenses like rent, salaries, utilities, and inventory.

Options Available:

Overdraft facility from your current bank

Invoice discounting

Term loans from banks/NBFCs

Government-backed schemes (like MUDRA)

These loans are often short-term and repayable within 12–36 months.

Real-Life Scenario

Anita, a 32-year-old entrepreneur in Pune, wanted to start a cloud kitchen. With no collateral and limited savings, she opted for the Startup India Loan Scheme through SIDBI. She later expanded her business using a loan against her family's residential property. Today, her startup employs over 25 people and earns over ₹30 lakh annually.

Frequently Asked Questions (FAQs)

1. Can I apply for a Startup India loan if my business is less than a year old?

Yes, as long as your startup is DPIIT-recognized and meets other eligibility conditions.

2. What is the maximum amount I can get under a business loan against property in India?

Loan amounts can range from ₹50,000 to over ₹7 crore, depending on the property's value and lender policies.

3. Do I need income proof to get a business loan?

For unsecured loans, income proof is often required. However, some fintech lenders offer business loans without ITRs based on turnover and bank statements.

4. Are government loans only for new businesses?

No. While some schemes target new startups, others like working capital loans and PMEGP are available to existing small businesses too.

5. How fast can I get online approval for a business loan?

With the paperless process, loan approval can happen within 24 to 72 hours, especially with fintech lenders.

Conclusion: Choose What Fits Your Business Best

India in 2025 offers more opportunities than ever for aspiring entrepreneurs. Whether you opt for the Startup India Loan Scheme, a government loan for new business startup in India, or a business loan against property, the key is to understand your funding needs and choose the best-fit loan product. For quick funding, explore how to apply for business loan online and leverage paperless business loan online approval systems. If you lack documents, consider an unsecured business loan without income proof or a working capital loan for small businesses in India.

#startup India loan scheme for new business#government loan for new business startup in India#business loan against property in India#how to apply for business loan online#paperless business loan online approval#unsecured business loan without income proof#working capital loan for small businesses in India

1 note

·

View note

Text

Top Benefits of Leasing Office Space for Rent in Dubai for Startups and SMEs

Finding the right office space is a crucial decision for startups and small businesses looking to establish themselves in Dubai. Leasing office space provides flexibility, cost-effectiveness, and access to essential amenities that contribute to business growth. This blog explores the top benefits of leasing office space for rent in Dubai and why it is a smart choice for startups and SMEs.

1. Cost-Effective Solution

One of the primary advantages of leasing an office space for rent in Dubai is cost savings. Purchasing a commercial property requires a significant upfront investment, which can be a challenge for startups with limited capital. Leasing allows businesses to allocate their financial resources more efficiently, focusing on growth and expansion instead of property ownership.

Additionally, leasing office space in Dubai through a provider like Nuoffices eliminates expenses related to property maintenance, utilities, and furnishing. Businesses can save on setup costs while enjoying a ready-to-use office environment.

Leased office spaces often come with flexible payment terms, allowing startups and SMEs to manage their cash flow effectively. Instead of being burdened with property taxes, loan repayments, and maintenance costs, businesses can redirect their funds into operations, marketing, and hiring the right talent.

2. Prime Business Location

Dubai is a global business hub, and having an office in a prestigious location enhances a company's reputation. Leasing office space for rent in Dubai gives startups access to strategic locations, making it easier to connect with clients, partners, and investors. Areas such as Business Bay, Downtown Dubai, and Deira offer excellent connectivity, boosting business opportunities.

A prime office address adds credibility to a business, creating a professional image that can impress potential customers and stakeholders. Additionally, being in a central location means better accessibility for employees, making commuting more convenient and improving overall work-life balance.

3. Flexibility and Scalability

For startups and SMEs, flexibility is key. Leasing office space provides the freedom to upgrade or downsize as the business evolves. Whether a company needs a small private office or a larger workspace, leasing options cater to changing requirements. This adaptability ensures that businesses only pay for the space they need at any given time.

Leasing also allows companies to test different locations and workspace setups before committing to a long-term arrangement. If a business experiences growth, it can easily relocate to a bigger space or opt for additional workstations without major disruptions.

4. Fully Equipped Workspaces

Leasing an office space for rent in Dubai through Nuoffices means gaining access to a fully furnished workspace with essential amenities such as high-speed internet, meeting rooms, and reception services. This eliminates the hassle of setting up an office from scratch, allowing businesses to start operations immediately.

Many leased offices also include shared facilities like conference rooms, lounge areas, and pantry spaces, creating a comfortable and productive environment for employees. Access to professional meeting rooms enables startups to host client meetings and presentations in a well-equipped setting.

5. Professional Image and Credibility

A well-established office space enhances a company's professional image. Leasing an office space for rent in Dubai allows startups to operate from a business-friendly environment, making a strong impression on clients and investors. A physical office address adds credibility to the brand, instilling trust in potential customers.

Moreover, working from a fully serviced office rather than a home office or co-working space gives businesses a competitive edge. It signals to clients and investors that the company is serious about its operations and growth.

6. Hassle-Free Maintenance and Services

When leasing an office, businesses benefit from maintenance services provided by the office space provider. This means no worries about facility repairs, security, or utility management. Nuoffices ensures that all maintenance aspects are handled efficiently, allowing businesses to focus on their core operations.

Having a dedicated support team to manage cleaning, IT infrastructure, and security enhances the overall working experience. Businesses do not have to allocate time or resources to handle these tasks, reducing operational burdens.

7. Networking Opportunities

Working from a shared or serviced office space fosters networking and collaboration. Leasing an office space for rent in Dubai places startups and SMEs in proximity to like-minded professionals, potential clients, and investors. Engaging with other businesses within the same office complex can lead to valuable partnerships and growth opportunities.

Networking events, workshops, and community initiatives often take place in serviced office environments, giving businesses a chance to interact with industry experts and potential partners.

8. Legal and Compliance Ease

Dubai has specific regulations regarding commercial property ownership for foreign businesses. Leasing an office space simplifies compliance with local laws and licensing requirements. Nuoffices provides support in ensuring that businesses operate within the legal framework, reducing administrative burdens.

For startups unfamiliar with Dubai’s business regulations, leasing an office from a reputable provider ensures smooth licensing procedures and adherence to government requirements.

9. Enhanced Employee Productivity

A well-designed office environment plays a vital role in employee productivity and satisfaction. Leasing an office space for rent in Dubai ensures that employees have a comfortable workspace, leading to improved efficiency and job satisfaction. Access to modern facilities, ergonomic furniture, and a professional atmosphere contributes to a positive work environment.

Having a dedicated workspace also helps employees maintain a better work-life balance compared to working from home. It creates a structured setting that encourages focus, teamwork, and collaboration.

10. Quick Setup and Business Continuity

Leasing an office allows startups to get their operations running quickly. Unlike setting up an office from scratch, which involves lengthy procedures, a leased office is ready for immediate use. This enables businesses to maintain continuity and focus on their objectives without unnecessary delays.

A well-established office space also provides backup facilities such as power generators, uninterrupted internet connectivity, and IT support, ensuring minimal disruptions to daily operations.

FAQs

1. What is the cost of leasing an office space for rent in Dubai?

The cost varies based on location, office size, and included amenities. Nuoffices offers flexible leasing plans to suit different business needs and budgets.

2. Is leasing office space in Dubai a better option than buying?

For startups and SMEs, leasing is often the better choice due to lower upfront costs, flexibility, and access to essential services without ownership responsibilities.

3. Can I upgrade to a larger office space if my business expands?

Yes, leasing offers the flexibility to upgrade or downsize based on business requirements. Nuoffices provides scalable office solutions to accommodate growth.

4. Are utilities and maintenance included in the lease?

Most office leasing agreements include utilities, security, and maintenance services, reducing operational hassles for businesses.

5. How can I find the best office space for rent in Dubai?

Partnering with a trusted provider like Nuoffices ensures access to prime office locations with the right amenities to support business growth.

Leasing an office space for rent in Dubai offers numerous benefits, making it an ideal solution for startups and SMEs. From cost savings to flexibility and professional credibility, a leased office supports business success while providing a conducive working environment. Nuoffices simplifies the process, ensuring that businesses have the right space to thrive in Dubai’s competitive market.

0 notes

Text

The Importance of Ag Financing for Modern Farming Operations

Access to capital is one of the most influential factors in the success and scalability of today’s agricultural enterprises. Farmers increasingly rely on structured financial support to manage seasonal expenses, upgrade machinery, and navigate market fluctuations. With the rising costs of inputs and technology-driven practices taking hold in rural America, the demand for tailored ag financing options continues to grow. Farmers must contend with unpredictable variables—weather, crop yields, and commodity prices—that impact their yearly earnings. Strategic borrowing helps stabilize these risks. Unlike traditional business financing, agriculture-specific funding accounts for unique cash flow cycles and long-term growth goals. Producers seek customized loan terms, low-interest rates, and flexibility in repayment schedules that align with harvest and sale periods. This ensures that funds are available when most needed, whether during planting season or major capital expenditures. For emerging producers or multigenerational farms alike, having access to dependable funding options is a cornerstone of sustainable agricultural operations.

With the rising complexity in farming practices, especially in areas adopting precision agriculture, financing must adapt to encompass both innovation and tradition. From row crops to livestock, diversified farms need credit lines that support ongoing investments in land, irrigation, feed, and infrastructure. Tailored ag financing solutions are designed to address these needs while promoting growth in both small and large-scale enterprises. These solutions may include operational loans, equipment financing, or lines of credit to fund seasonal activity. Crucially, they ensure that farm businesses can maintain operations without sacrificing long-term goals or weathering market downturns unsupported. With a well-structured financing plan, producers can also take advantage of expansion opportunities, land purchases, and strategic improvements. Strong relationships with knowledgeable lending partners who understand the seasonal nature and volatility of farming provide a major advantage. As agricultural demands evolve, financing must remain responsive, offering not just funds, but advisory support and sector-specific insight that contributes to the long-term health of rural economies.

How Ag Finance Supports Long-Term Growth in Agriculture

Agriculture has transitioned from a primarily subsistence-based practice into a sophisticated, market-responsive industry. This evolution requires smarter, long-term financial planning that only purpose-built ag finance can offer. For example, soil health initiatives and sustainable practices such as rotational grazing or cover cropping can have upfront costs but yield significant benefits over time. The ability to finance such strategies without straining current operations ensures continuity and resilience. As younger generations enter the farming sector, they seek out financial products that not only support immediate working capital needs but also enable legacy planning. Farm succession, diversification, and climate resilience are becoming increasingly important factors in long-term farm finance decisions. Therefore, ag-specific finance offers a roadmap that supports environmental, operational, and generational continuity.

Access to capital for infrastructure upgrades, such as cold storage, grain bins, and greenhouse facilities, allows farms to compete in high-value markets and manage inventory more effectively. Equipment financing also allows farms to reduce labour-intensive operations and increase productivity through automation. Leveraging farm credit enables farm operators to modernize while maintaining financial stability. Lenders familiar with the agricultural landscape can structure loans that accommodate market trends, ensuring the borrower is not overextended during downturns. In essence, strategic ag finance doesn’t just fund the farm—it funds the future of agriculture by promoting business practices that balance immediate profitability with long-term stewardship of the land and community.

Why Choosing the Right Ag Lenders Matters

Working with experienced ag lenders is critical for agricultural operators navigating the complex terrain of modern farming finance. These specialists provide more than just access to money—they offer insight, risk assessments, and flexible structures based on the unique economic cycles of farming. While traditional lenders may not fully understand the nuances of agriculture’s seasonality or long asset lifespans, dedicated ag lenders can tailor loans to reflect the true needs of the producer. Whether a farmer is focused on dairy, row crops, or specialty products, loan products should reflect operational cycles, production goals, and long-term sustainability. Personalized service and deep regional understanding help strengthen the borrower-lender relationship, which can be instrumental when adjustments are needed due to droughts, market shifts, or equipment failures. These lenders also understand regulatory frameworks and can support farmers in accessing government programs, grants, and crop insurance, adding further layers of protection.

Reliable farm lenders also recognize the importance of building credit history within agricultural communities. For new or smaller operations, establishing financial credibility is a significant milestone, and working with lenders who appreciate the long view of farming can facilitate this. With the right partnership, farmers can take strategic steps toward growth, confident that their financing partner supports not just the balance sheet, but the broader vision of farm success. Choosing lenders who specialize in agriculture ensures that credit structures are realistic, future-focused, and tied directly to real-world farm operations.

The Role of Agricultural Lenders in Economic Resilience

The broader rural economy depends heavily on reliable agricultural lenders who can provide capital access across sectors, from crop production to agri-tourism. These lenders support rural development by investing in community businesses that drive job creation and food production. They offer loan options that account for seasonal income fluctuations, land valuation challenges, and operational diversity. Agricultural lending institutions are often deeply embedded in the communities they serve, creating local partnerships that reinforce resilience. These lenders also often engage in educational outreach and provide resources to help farmers make informed borrowing decisions. Whether funding expansion or providing working capital during lean seasons, agricultural lenders act as a backbone to regional economies.

Their familiarity with local commodities, weather patterns, and marketing channels allows them to make more accurate assessments of risk and opportunity. Rather than applying cookie-cutter lending models, they work one-on-one with producers to assess cash flow, asset longevity, and long-term market potential. This personalised approach empowers borrowers to operate confidently, knowing their lender is aligned with their goals. By supporting innovation, succession planning, and soil health improvements, agricultural lenders help ensure that the countryside remains vibrant and productive for future generations.

Farm Credit Services as a Comprehensive Support System

Specialised farm credit services go beyond loans by offering financial guidance, benchmarking, insurance coordination, and retirement planning tailored to agriculture. These services allow farmers to gain a holistic view of their financial standing, providing tools for better planning and decision-making. For example, cash flow projections and profitability models can help producers decide when to reinvest or scale operations. Risk mitigation strategies are also embedded into these services, including crop insurance, livestock protection, and hedging instruments. By making these resources accessible, farm credit providers support operational efficiency and financial literacy.

Comprehensive farm credit services create value not just through lending but through building farmer competence in business strategy and resilience. Whether it's advice on navigating interest rate fluctuations or structuring multigenerational farm transitions, these services are tailored to the complexities of modern agriculture. Educational seminars, credit workshops, and access to advisory networks empower producers to take charge of their financial futures. Through integrated support systems, farmers can build long-term plans that incorporate personal goals, environmental sustainability, and community engagement.

Why Farm Credit in Kansas Stands Out

In agriculturally rich states, farm credit kansas programs are critical for sustaining a thriving rural economy. These programs focus on empowering farmers with localized knowledge, flexible financing, and long-term planning tools. In regions like Kansas where agriculture drives a substantial portion of the state economy, farm-specific credit providers must balance climate risks, commodity pricing, and land management concerns. Access to experienced loan officers who understand these regional variables provides farmers with a level of support that goes beyond basic banking. This direct engagement means that credit solutions are more likely to be aligned with market conditions and personal farm objectives.

Kansas-based credit systems also often collaborate with local institutions to provide community-based initiatives, workshops, and access to conservation funding. These partnerships deepen the value of credit access and encourage participation in regional development. Producers in the area benefit from a lender network that not only finances operations but also contributes to the ongoing development of agricultural best practices and land stewardship. Farm credit programs in this state often serve as a model for how localised financial systems can be optimised for agricultural impact.

Supporting Rural Growth Through High Plains Credit Union

When choosing a credit institution, farmers often gravitate toward cooperatives like high plains credit union that are deeply connected to rural needs. These organizations are typically member-owned, meaning they reinvest profits into the communities they serve through dividends, educational grants, and lower loan rates. Their governance model also allows for more flexible policies that evolve with the challenges of rural life. For many producers, joining a rural credit union means gaining access to competitive financial products along with a support network built on shared agricultural values.

Credit unions focused on agriculture often promote inclusivity for small and mid-size farms, providing access to funds that might not be available through large commercial banks. They also champion rural advocacy and community development through agricultural scholarships, youth programs, and investment in local infrastructure. Their presence contributes not just to individual farm stability but to the vitality of entire agricultural communities. This dual focus on financial well-being and local enrichment makes them invaluable partners in the future of farming.

#ag financing colorado#ag financing kansas#ag financing nebraska#ag finance#ag loans#ag financing#agricultural loans#ag lending

0 notes

Text

Simplify Trading with Finsta: Your Trusted Partner in Loan Management Software

In today’s dynamic financial world, having a reliable trading account is more than just an advantage — it’s a necessity. Whether you're an individual trader, a financial institution, or a growing fintech company, choosing the right platform to manage your transactions and loans can make a significant difference. This is where Finsta, a trusted name in loan management software, steps in.

Why Choose Finsta for Your Trading Account?

Finsta is designed for the modern financial landscape, offering intuitive tools that seamlessly integrate fintech software with advanced trading capabilities. A trading account with Finsta ensures not just ease of use but also the highest standards of security, performance, and scalability.

At the heart of Finsta’s services is its powerful loan management software for this article. Built for efficiency, the platform automates and streamlines the loan process, from origination to closure, reducing manual work and minimizing errors.

Features That Set Finsta Apart

Complete Loan Management: From loan creation to repayment tracking, Finsta’s loan management software handles it all effortlessly.

Fintech-Ready Solutions: Integrated fintech software tools ensure that your trading account stays in sync with the latest technological advancements.

Customization: Tailor your workflows and reports to match your specific business needs.

Compliance Support: Stay updated with the latest regulations using Finsta's built-in compliance checks.

Finsta and Loan Organization Systems

One of the standout features of Finsta is its robust loan organization systems,Effectiveness is crucial for institutions managing a large portfolio of clients and loans. Finsta provides easy sorting, scheduling, and tracking of all loans, ensuring that no detail is ever missed.

By choosing Finsta, businesses get access to the best loan management systems in the market. The software's intuitive design and comprehensive functionalities make it the best loan management software choice for small businesses and large financial enterprises alike.

Why Finsta is a Top Loan Management Software Company

Being a reputed loan management software company, Finsta understands the complexities of financial management. Their specialized solutions are crafted to support scalability, compliance, and profitability. Whether you need to upgrade your existing systems or start from scratch, Finsta’s team is ready to customize the best fit for your needs.

Their solutions also feature seamless integration options, so businesses already using other financial tools can experience a smooth transition without disruptions.

Conclusion

Managing a trading account and loan operations has never been easier. With Finsta’s cutting-edge fintech software, reliable loan organization systems, and status as one of the best loan management systems providers, your financial management becomes smarter, faster, and more secure.Visit Finsta today to explore the future of trading and financial organization!

0 notes

Text

Simplify Trading with Finsta: Your Trusted Partner in Loan Management Software

In today’s dynamic financial world, having a reliable trading account is more than just an advantage — it’s a necessity. Whether you're an individual trader, a financial institution, or a growing fintech company, choosing the right platform to manage your transactions and loans can make a significant difference. This is where Finsta, a trusted name in loan management software, steps in.

Why Choose Finsta for Your Trading Account?

Finsta is designed for the modern financial landscape, offering intuitive tools that seamlessly integrate fintech software with advanced trading capabilities. A trading account with Finsta ensures not just ease of use but also the highest standards of security, performance, and scalability.

At the heart of Finsta’s services is its powerful loan management software for this article. Built for efficiency, the platform automates and streamlines the loan process, from origination to closure, reducing manual work and minimizing errors.

Features That Set Finsta Apart